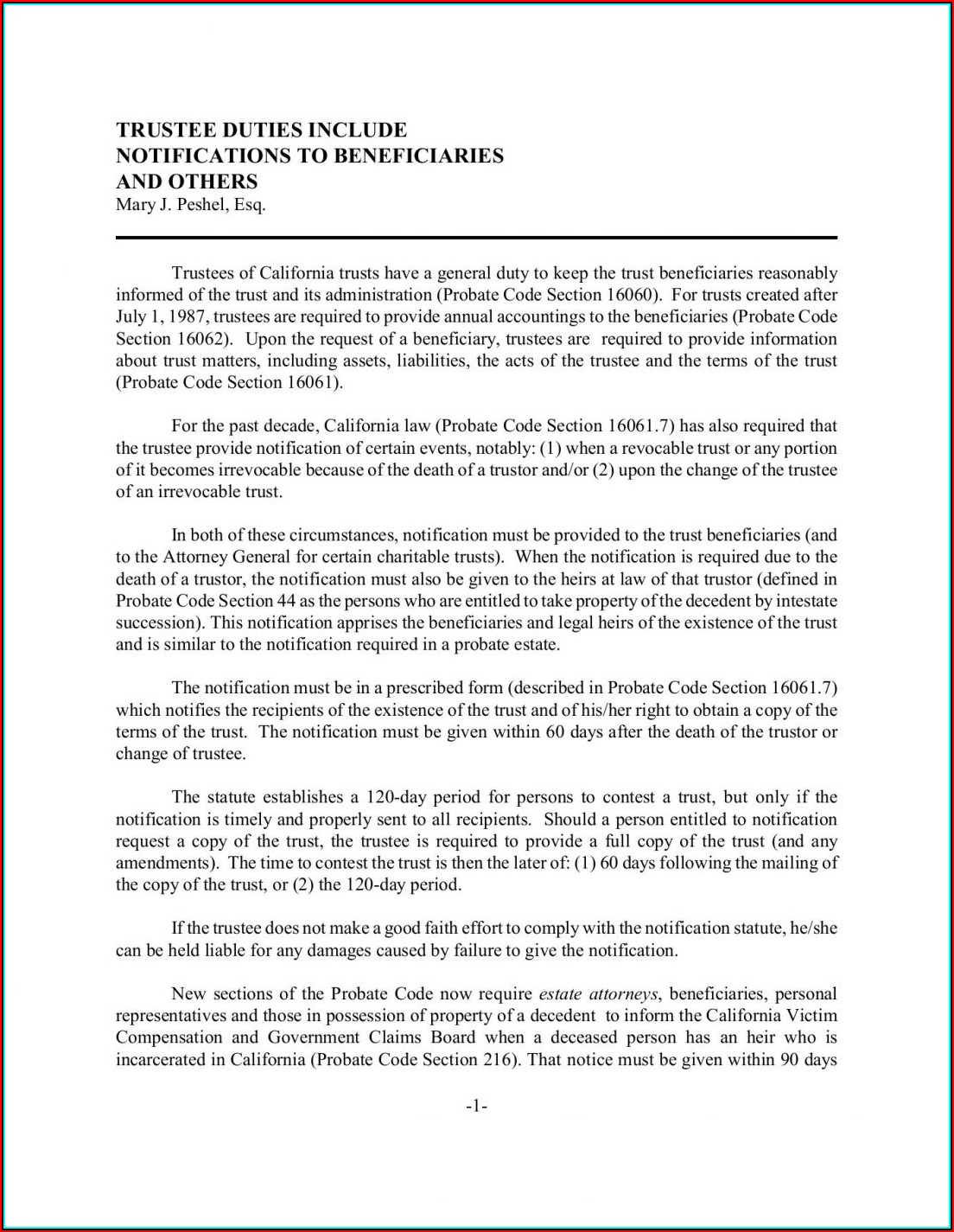

Free Revocable Living Trust Form Illinois. Free Living Trust forms are very easy to draft and can help your beneficiaries save time and money, including court costs and attorney fees. Your Living Trust refers to a separate written statement and you may dispose of your tangible personal property in this manner if you so desire.

When thinking about your estate planning options, consider whether a trust might be right for you.

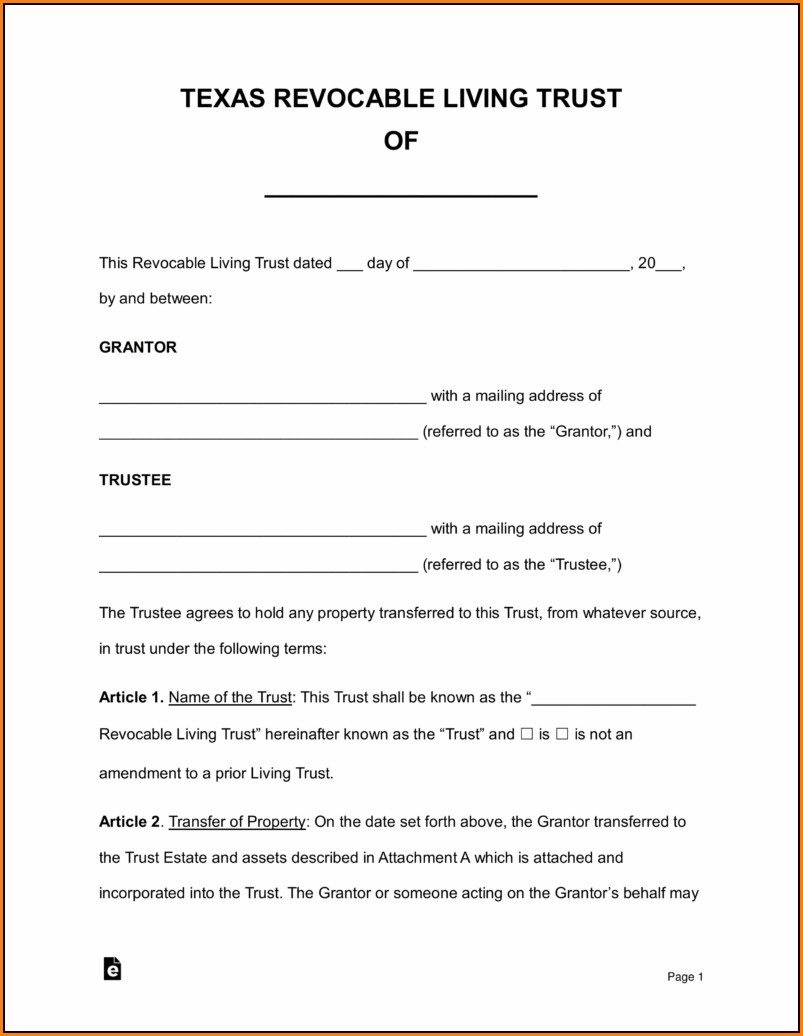

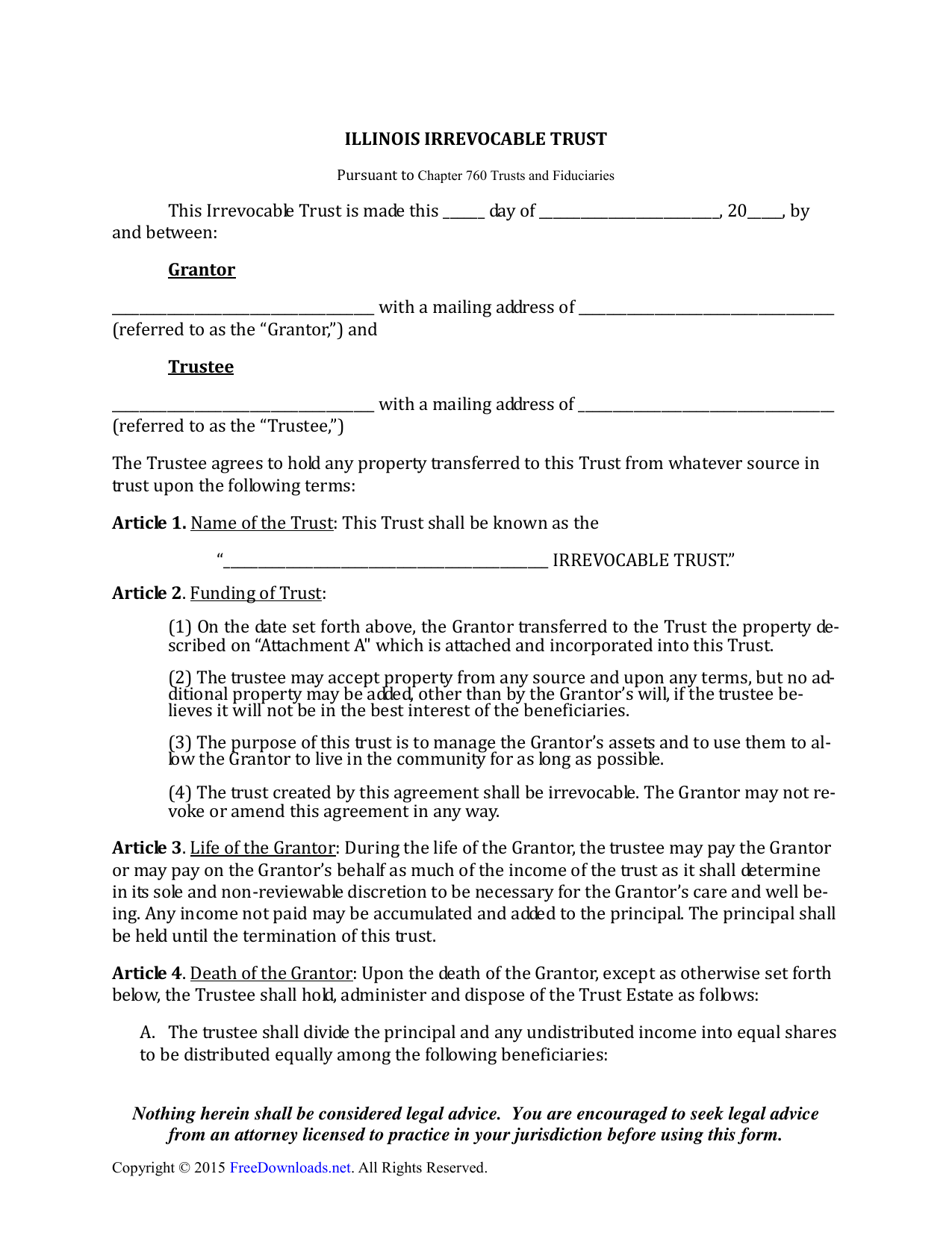

Settlor desires to create a revocable trust of the property described in Schedule A hereto annexed, together with such monies, and other assets as the Trustee may hereafter at any time hold or acquire.

A revocable living trust is a good method of managing assets during life while preparing for the Some Illinois residents choose to plan their estates and get their affairs in order using revocable The grantor is free to select another person to be the trustee if they so choose. Settlor desires to create a revocable trust of the property described in Schedule A hereto annexed, together with such monies, and other assets as the Trustee may hereafter at any time hold or acquire hereunder (hereinafter referred to collectively. The Illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in Illinois.